In-Depth Example: Calculating the FCF Payout Ratio

To illustrate the difference between the traditional Earnings Payout Ratio and the more reliable Free Cash Flow (FCF) Payout Ratio, let’s analyze two major European companies, TotalEnergies and Sanofi, using hypothetical (but realistic) data for a given year.

Why FCF is Better

Earnings Per Share (EPS) can be skewed by non-cash charges like depreciation, amortization, or one-time gains/losses. Free Cash Flow represents the actual cash a business generates after maintaining its assets (Capital Expenditures or CapEx)—the cash flow available to return to shareholders.

Company A: TotalEnergies (TTE) – The Energy Giant

| Metric | Value | Source |

| Annual Dividend per Share | €2.81 | Public Disclosure |

| Number of Shares Outstanding | 2,500 million | Financial Report |

| Earnings Per Share (EPS) | €6.50 | Financial Report |

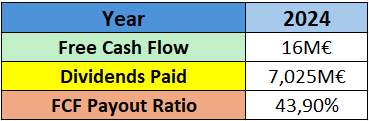

| Free Cash Flow (FCF) for the year | €16,000 million (or €16 Billion) | Financial Report |

1. Calculate Total Dividend Paid

Total Dividends Paid = Annual Dividend per Share / Shares Outstanding

Total Dividends Paid = €2.81 / 2,500,000,000 = €7,025 million

2. Calculate the FCF Payout Ratio

FCF Payout Ratio = Total Dividends Paid / Free Cash Flow

FCF Payout Ratio = €7,025 million / €16,000 million = 43.9\%

3. Calculate the EPS Payout Ratio (For Comparison)

EPS Payout Ratio = Annual Dividend per Share / EPS

EPS Payout Ratio = €2.81 / €6.50 = 43.2%

TotalEnergies Conclusion: Both ratios are very similar and fall comfortably below the 60% mark. This indicates that the company’s dividend is highly sustainable and well-covered by its operational cash flow.

Company B: Sanofi (SAN) – The Pharmaceutical Leader

| Metric | Value | Source |

| Annual Dividend per Share | €3.56 | Public Disclosure |

| Number of Shares Outstanding | 1,250 million | Financial Report |

| Earnings Per Share (EPS) | €4.05 | Financial Report |

| Free Cash Flow (FCF) for the year | €5,200 million (or €5.2 Billion) | Financial Report |

1. Calculate Total Dividend Paid

Total Dividends Paid = €3.56 / 1,250,000,000 = €4,450million

2. Calculate the FCF Payout Ratio

FCF Payout Ratio = €4,450million / €5,200 million = 85.6\%

3. Calculate the EPS Payout Ratio (For Comparison)

EPS Payout Ratio = €3.56 / €4.05 = 87.9\%

Sanofi Conclusion: The high EPS Payout Ratio (87.9%) is immediately concerning, as it suggests the company is paying out nearly all its reported profit. The FCF Payout Ratio (85.6%) confirms this concern. While a pharmaceutical company might be able to sustain a high payout ratio temporarily due to stable, non-cyclical sales, an 85% ratio means they have very little margin for research and development (R&D) or unexpected setbacks. This dividend is less secure and the yield should be treated with caution, despite the company’s size.

🔑 Key Takeaway

Always prioritize the FCF Payout Ratio. If the FCF Payout Ratio is significantly lower than the EPS Payout Ratio, the dividend is more sustainable. If both are high (above 80%), the yield is likely at risk of being cut or frozen, and the high yield you see today may not be accurate in the future.