We cannot talk about finance in 2025 without talking about cryptocurrency. So I decided to make a quick series of articles about cryptocurrency. Here’s the first one.

Introduction: The Dawn of Digital Money

For decades, we’ve relied on traditional finance—banks, central governments, and paper money. But the digital revolution gave birth to a new concept: Cryptocurrency. It’s a term often heard in the news, linked to phenomenal gains or significant market volatility.

But what exactly is a cryptocurrency, and why is it constantly hailed as the future of finance? Simply put, a cryptocurrency is a form of digital or virtual money that is secured by cryptography, making counterfeiting nearly impossible. Crucially, most cryptocurrencies are decentralized, meaning they are not controlled by any single entity, like a bank or a government.

The technology that makes this possible is called the Blockchain.

1. Decoding the Cryptocurrency Concept

- Digital Currency: Cryptos exist purely as digital data. There are no physical coins or bills; transactions are recorded on a digital ledger.

- Cryptography is Key: Cryptography (advanced encoding) secures every transaction and verifies the transfer of assets. This protection is what gives cryptocurrencies their name.

- Decentralization: This is the game-changer. Unlike the Euro or the Dollar, which are issued and regulated by central banks, cryptocurrencies operate on a peer-to-peer (P2P) network. This removes the need for intermediaries, giving individuals more control over their own funds.

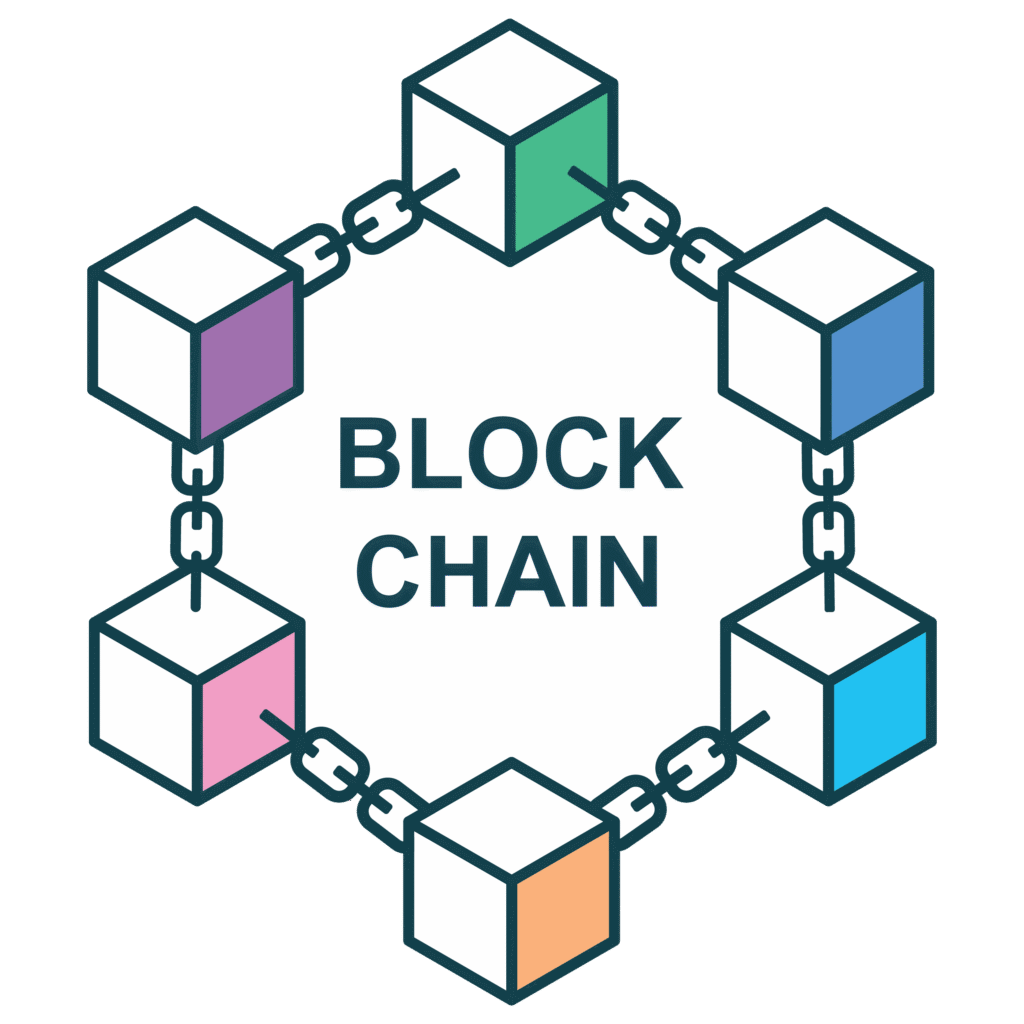

2. The Engine Room: Understanding the Blockchain

The Blockchain is the foundational technology that powers almost every cryptocurrency. Think of it as a shared, immutable, and constantly updated ledger that is distributed across a massive network of computers.

How Blocks are Formed:

- The Transaction: A user initiates a transaction (e.g., sending Bitcoin to another person).

- The Block: This transaction, along with many others, is gathered into a block. The block is then cryptographically secured and assigned a unique code (a hash).

- Validation (The Consensus Mechanism): Before the block can be added, it must be validated by the network’s participants. This is done through a consensus mechanism.

- Proof-of-Work (PoW): Requires participants (miners) to use significant computing power to solve a complex mathematical puzzle. This is the mechanism used by Bitcoin.

- Proof-of-Stake (PoS): Requires participants to “stake” (lock up) some of their existing coins to have a chance to validate transactions. This is a more energy-efficient method used by Ethereum (post-Merge).

- The Chain: Once validated, the new block is added to the end of the existing chain of blocks in a chronological and tamper-proof manner. Every new block contains the hash of the preceding block, linking them securely—hence the name Blockchain.

3. Key Advantages and Disadvantages of Cryptocurrencies

While revolutionary, cryptocurrencies present both compelling benefits and serious drawbacks.

| 👍 Advantages | 👎 Disadvantages |

| Transparency | Volatility |

| Every validated transaction is public on the ledger. | Prices can fluctuate wildly in short periods, posing a high risk for investors. |

| Low Transaction Fees | Regulatory Uncertainty |

| For international transfers, fees can often be much lower and faster than traditional wire transfers. | Governments are still debating how to classify and regulate cryptocurrencies, creating legal risks. |

| Accessibility | Irreversible Transactions |

| Anyone with an internet connection can participate, reducing barriers to financial services. | Once a transaction is confirmed on the blockchain, it cannot be reversed. Mistakes are permanent. |

| Security (Immutability) | Scalability Challenges |

| Once a block is added, it cannot be altered or deleted, making the ledger highly secure against fraud. | Some Blockchains (like Bitcoin’s) can only process a limited number of transactions per second. |

Conclusion: Ready to Explore Further

Cryptocurrency and the Blockchain are more than just financial tools; they represent a fundamental shift in how we view trust and value exchange in the digital age. By removing the need for central authorities, they empower the individual and open up a new universe of financial possibilities.

Pingback: Bitcoin Ultimate Guide